Trang Chính

Blog Phạm-Hoàng-Tùng:Biển Cả Và Con Người:

Bưu-Hoa Việt-Nam:

Chết Bởi Trung Cộng:

Địa-Linh Nhân-Kiệt Của Việt-Nam:

Điện-Toán - Tin-Học:

Ebooks Hồi-Ký - Bút-Ký:

Hịch Tướng Sĩ:

Hình-Ảnh Quân-Lực Việt-Nam Cộng-Hòa

History Of Viet Nam

Hoàng-Sa Trường-Sa Là Của Việt- Nam:

Hồ-Sơ Chủ-Quyền Quốc-Gia Việt- Nam

Hội Sử-Học Việt-Nam

Vietnam Human Rights - Human Rights Activist

Lá Thư Úc-Châu

Lịch-Sử Việt-Nam Cận-Đại:

Lịch-Sử Việt-Nam Ngàn Xưa:

Ngàn Năm Thăng Long (1010 - 2010)

Nghĩa-Trang Quân-Đội Biên-Hòa

Nguyên-Tử Của Việt-Nam Và Quốc- Tế

Người Dân Khiếu-Kiện:

Phụ-Nữ, Gia-Đình, Và Cuộc Sống:

Quốc-Tế:

Sitemap:

Southeast Asia Sea:

Tiền-Tệ Việt-Nam:

Tin Nhắn, Tìm Thân-Nhân Mất-Tích, Mộ Tìm Thân-Nhân:

Tin-Tức Thời-Sự Việt-Nam:

Thư-Tín:

Tòa Án Hình Sự Quốc Tế Về Việt Cộng và Trung cộng:

Tưởng-Niệm 50 Năm 1963 - 2013 :

Ủng Hộ Trúc-Lâm Yên-Tử - Donate:

Thư Mục Các Trang Web - Weblinks:

Cây có cội, nước có nguồn. Toàn dân Việt-Nam ngàn đời ghi nhớ ân đức Quốc Tổ Hùng Vương

Southeast Asian Seas

Chuyên mục Southeast Asia Sea được thành lập nhằm khẳng định chủ quyền biển Đông từ hơn 10 ngàn năm của dân tộc Việt-Nam.

Từ hơn 10 ngàn năm qua, dân tộc Việt-Nam đã sống với biển, gần biển. Đây là nền văn minh chói sáng của tộc Việt.

Tình cảm gắn bó giữa biển và con người Việt Nam đã có chiều dài hàng 10 ngàn năm và tình cảm này vĩnh viễn không thể nào chia cắt được cho dù trải qua nhiều sự thay đổi của lịch sử.

Outflows Are Back: $87B Leaves China in November

By Valentin Schmid, Epoch Times | December 7, 2015

Last Updated: December 8, 2015 8:09 am

A guide stands in front of an electronic board at the entrance of a bank in Beijing on April 23, 2013. (Wang Zhao/AFP/Getty)

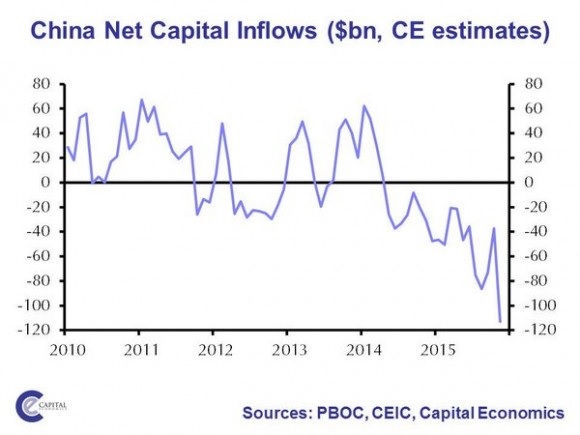

China seemed to have caught a break in October, but capital outflows came back in full force in November.

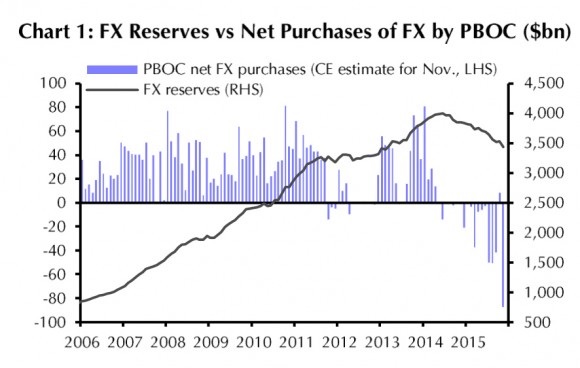

According to central bank data, foreign exchange reserves fell $87 billion to $3.44 trillion. The drop is almost as large as the record of $94 billion set in August.

“The increased likelihood of a December Fed rate hike will also have added to outflow pressures,” Capital Economics writes in a note to clients.

The Dec.7 fixing for the Chinese yuan suggests these pressures persist in December.

The People’s Bank of China (PBOC) set the midpoint r ate at 6.3985 per dollar prior to market open, 0.21 percent weaker than the previous fix 6.3851, the lowest since late August.

Chinese capital outflows are a hot topic because until the trend reversed in 2014, the country just kept accumulating foreign capital to the tune of $4 trillion. It has been downhill ever since and total capital outflows could hit $1 trillion by the end of the year.

(Capital Economics)

A slow economy, a falling stock market, an increasing number of corporate defaults, and a post-bubble real estate market force domestic and international investors to get their money out.

When China sells foreign exchange reserves, it sells mostly U.S. Treasurys to keep the value of the yuan stable.

But the drop in foreign exchange reserves do not reflect the total of capital outflows. Foreign trade, foreign direct investment, as well as swings in the value of the assets held as foreign exchange reserves also influence this figure.

According to Capital Economics, movements in asset values and currencies reduced the dollar value of the foreign exchange reserves by around $30 billion. So the PBOC only actively sold $57 billion.

Capital Economics then adds back the trade surplus for November ($57 billion) and calculates total outflows of $112 billion.

READ: How to Calculate an Estimate of China’s Capital Outflows

According to Goldman Sachs, the currency valuation figure could be as high as $47 billion.

Goldman also thinks PBOC data is not comprehensive, as it neglects the activity of the state controlled banking system.

“Headline foreign exchange reserve data may not necessarily give a comprehensive picture on the underlying trend of [currency] conversion by corporates and households,” the analysts write. China’s sovereign wealth fund SAFE releases this data on Dec. 17.

(Capital Economics)

However, the analysts think the recent addition of the yuan to the International Monetary Fund’s (IMF) reserve currency basket doesn’t have anything to do with the weakening of the yuan and foreign exchange outflows.

READ: The IMF’s Reserve Currency Explained

“The PBOC appears concerned that a depreciation would set back their efforts to encourage increased international use of the currency and could slow the process of economic rebalancing toward consumption,” writes Capital Economics.

Thư-Viện Bồ Đề Online @ Trúc-Lâm Yên-Tử

Việt-Nam Sử-Lược Tân-Biên_Lịch-Sử Việt-Nam

Việt-Nam Sử-Lược Tân-Biên_Lịch-Sử Việt-Nam

***

Bài Viết Tin-Tức Thời-Sự Mới Nhất có liên quan đến Lịch-sử Việt- Nam và Lich su viet nam

Vua Trần Nhân Tông:

Thư-Viện Bồ Đề Online:

Trang Bài Viết Của Các Tác Giả :(Bằng-Phong Đặng-Văn-Âu; Bình-Minh; Bút Xuân Trần-Đình-Ngọc; Dạ-Lệ-Huỳnh; Đặng-Quang-Chính; Điệp-Mỹ-Linh; nguyễn-duy-ân; Nguyễn-Hàm Thuận-Bắc; Ông Bút; Trần-Đăng_Chân-Chính; Đặng-Huy-Văn; Kita Kha; Lê-Anh-Hùng; Lu-Hà; Mây Cao-Nguyên; Mây Ngàn; Mặc-Khách; Minh-Di; Nguyễn-Doãn-Kiên; Nguyễn-Nhơn; Nguyễn-Quang-Duy; Nguyễn-Thái-Sơn; Nguyễn-Thu-Trâm 8406; Trần-Văn-Giang; Quách-Vĩnh-Thiện; Mai-Hoài-Thu; Minh-Vân; Nguyễn-Chí-Thiện; Nguyễn-Khôi; Nguyễn-Thị-Thanh; TL Nguyễn-Việt Phúc-Lộc; Nhật-Hồng Nguyễn-Thanh-Vân; Phạm-Ngọc-Thái; Phan-Văn-Phước; Quê-Hương; Thanh-Sơn; ThụcQuyên; ThụcQuyên; Vĩnh-Nhất-Tâm; Trang Trần-quốc-Kháng_Truyện Dài Thời Chiến-Tranh Việt-Nam (Ebooks):

***

Châm Biếm - Điện-Ảnh - Thơ Văn - Sáng-Tác - Hồi-Ký - Triết-Học - Truyện Ngắn

________

- Giới-Thiệu Các Web, Blog Mới - Trúc-Lâm Yên-Tử